What is life about?

We have been told that life consists of following this checklist:

Get through K-12

Go to college

Work

Get married

Have Children

Retire

Die

Even if you do not like this model of life, you may base many of your ideas off of it. It’s been ingrained in all of us to think this way.

This model worked for a long time.

K-12 and college seemed harmless, while at the same time producing relatively competent people. Education wasn’t outrageously expensive and any additional schooling was likely a massive career booster.

If you still think school/college is worth it, you should check out these articles:

You’d hopefully get a good job (one that would allow you to live a fairly comfortable life) then you’d get married, have kids, and retire later on down the line.

Some call this The American Dream.

Yet, this same model now leads to a life of constant struggle…

Months ago my father and I were talking about the typical way of life for most Americans. I had just turned 18 and, despite the fact that I don’t want to follow the “norm”, the idea that I should immediately be completely independent still loomed over me.

As it does for most others my age.

During this conversation I heard my father mention “The Doom Loop” for the first time. At it’s core, The Doom Loop is meant to describe a long, drawn-out financial spiral.

One that’s nearly unrecoverable.

It’s an enticing and easy trap to fall into today. So much so that 20% of people making $250,000/year live paycheck to paycheck.

Bank of America economists tapped anonymized client data to look at customers' deposit accounts in the first quarter of 2022, zeroing in on inflows of cash, like income and other deposits, as well as outflows, such as credit card payments.

As people's income rises, their spending often exceeds earnings and other deposits, the Institute found. Indeed, roughly 20% of BofA clients with annual incomes of more than $250,000 spent 15% above what they deposit into their accounts, according to the report. By comparison, 17% of customers who earn between $50,000 and $100,000 tend to spend more every month than they have coming in

It doesn’t take much to succumb to The Doom Loop nowadays. Inflation, lack of job prospects, and college debt put everyone at a disadvantage. Any young person seeking to be independent is getting crushed.

Want to move out, get your own place, and provide for yourself?

Good luck.

The simple expense of groceries is enough to demoralize anyone looking to build a life for themselves…

“Groceries are shaping up to be a top spending priority for younger generations, a February report from McKinsey & Company found.

The firm asked over 4,000 people, from baby boomers to Gen Zers, about the categories they intend to splurge on this year. Groceries ranked highest for millennials and Gen Zers, outpacing restaurants, bars, travel, beauty and personal care, apparel, and fitness.”

“All generations are feeling the pinch of inflation at grocery stores and for goods and services in general. The typical American household would need to spend $445 more a month to purchase the same goods and services as a year ago, a report from Moody's found.”

The typical life path doesn’t work anymore. Trying to cover basic expenses prompts an incredible, never-ending struggle for most.

The Old Ways Have Got To Go

There’s another factor to all this…our culture promotes unbridled spending.

The care-free era that the boomers took full advantage of set the stage for the “life checklist” we currently have. But, the ideas which dominated the time of the boomers are clashing with the harsh reality we all face.

This brings me back to another article I wrote a while ago…Money Dysmorphia.

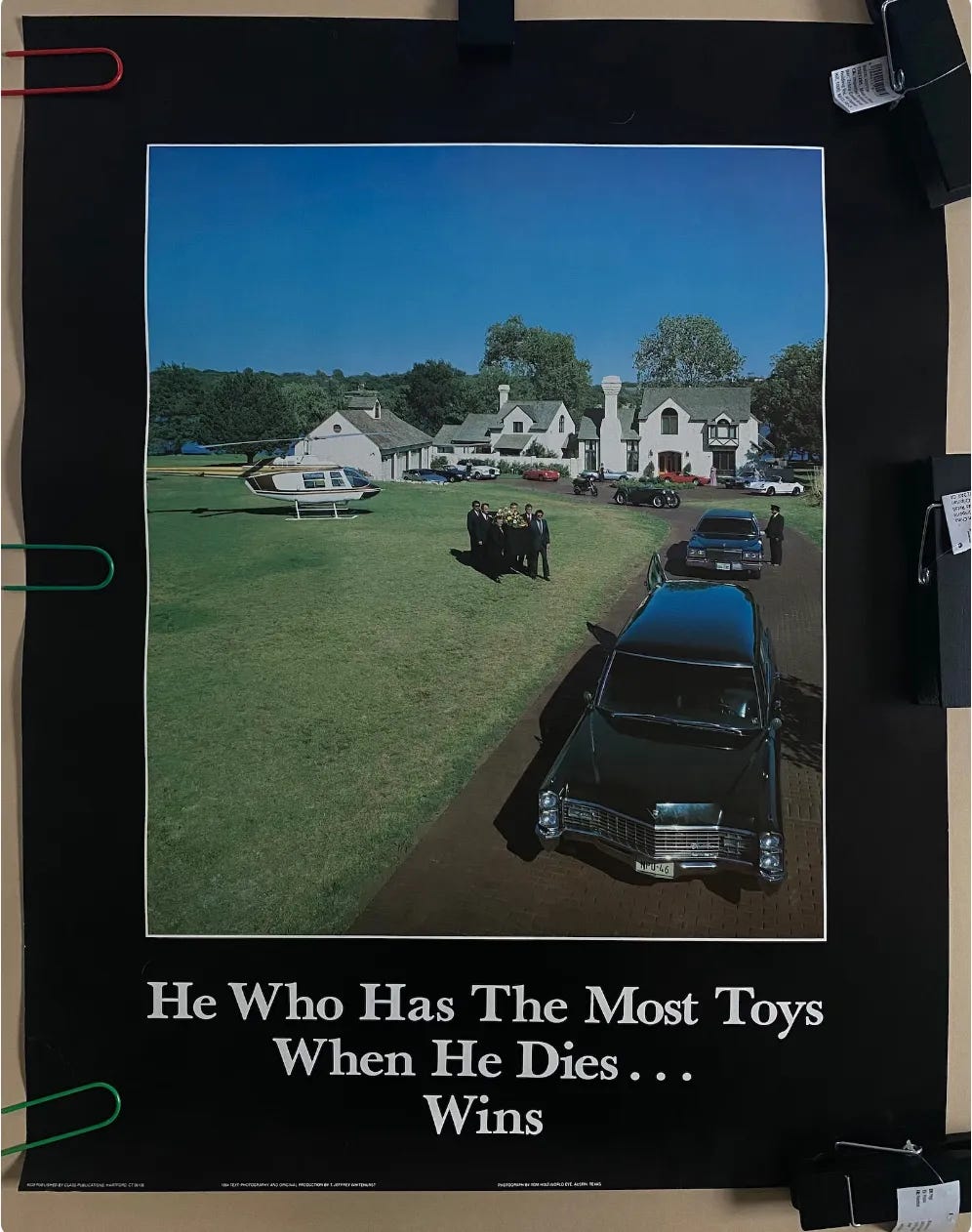

(A poster of a popular saying in the 80s)

“Advertising has got us chasing cars and clothes, working jobs we hate so we can buy shit we don’t need.”

-Tyler Durden

This sentiment is still very much around today. Our culture demands that we spend, spend, spend.

The accumulation of material possessions drives our soulless culture.

Although my generation has much less wealth than the boomers, many of us still cannot break the habit of frequent, ritualized money spending.

Further down The Doom Loop we stray…

Opting Out

Many young men are looking around and saying, “Oh to hell with it all.”

And how could you blame them?

Innumerable factors are working against any and all who wish to actually do something with their lives. The way out isn’t clear, so, opting out of the system seems like the best bet to some.

Four decades ago, 85% of 25-year-old men were working full-time. In 2021, it was 71%. Financial independence among this group declined from 77% in 1980 to 64% in 2021.

Even the idea of getting married and having kids is becoming less desirable to young men.

The number of young men who are interested in having kids is on the decline, according to new research published in Journal of Marriage and Family.

The study’s author, Robert Bozick, collected data from three different sources — the National Survey of Family Growth, the Panel Study of Income Dynamics and a study called “Monitoring the Future” — looking at more than 40,000 young American men over two decades.

According to one of the data sets, the number of male high school seniors who say they never want kids has more than tripled between 2000 and 2019.

You see, although The Doom Loop is primarily focused on a financial spiral, nearly every aspect of our culture has been driven into a deep chasm, full of meaninglessness.

The saying, “The Doom Loop”, could be used to describe any part of our culture.

Education has fallen off the rails. Your kid is much more likely to be indoctrinated into hating himself for his skin color, or wishing to be transgender.

A college degree doesn’t seem to get you anywhere. Students find themselves taking on more and more debt, for what? Just to find that their degree doesn’t hold as much weight as they were led to believe.

They aren’t actually guaranteed a job.

Most jobs are depressing beyond belief. Especially with increasing numbers of tech-based jobs, people are expected to spend the majority of their life in front of a computer. Never mind the fact that you’ll probably be living on a tight budget no matter if you have a cushy job or not.

Getting married and having children. Those are fantastic things, but who would want to settle down with the current selection of American women?

Frankly, all of these topics deserve a deeper dive to properly demonstrate the reality of our circumstances.

Perhaps our society is literally The Doom Loop?

The Path Forward

I don’t blame anyone for opting out of our culture. It’s good that people are beginning to do so.

But, the way out of all this is through action, not inaction.

It’s high time that we all create our own life checklists, direct our own lives, and disregard societal pressures.

At this very moment I’m being used as a beta-tester for The Preparation, a program designed for ambitious men looking for an unconventional route in life, a route of their own.

The Preparation isn’t just about what you can have, but who you can be and what you can do. For less money and a lot less time than college, you could become a competent fighter, healer, horseman and pilot.

And that's not all.

You'd still have time and money left over to learn to sell and know how to start your own business.

You could know how to design and build your own home. You could obtain the skills to survive in the wild and comfortably speak a second (or third) language.

Each week I post an update on what I’ve accomplished. By doing this I’m holding myself accountable, while also trying to show other young people like myself what is possible.

The Preparation will keep you far away from The Doom Loop.